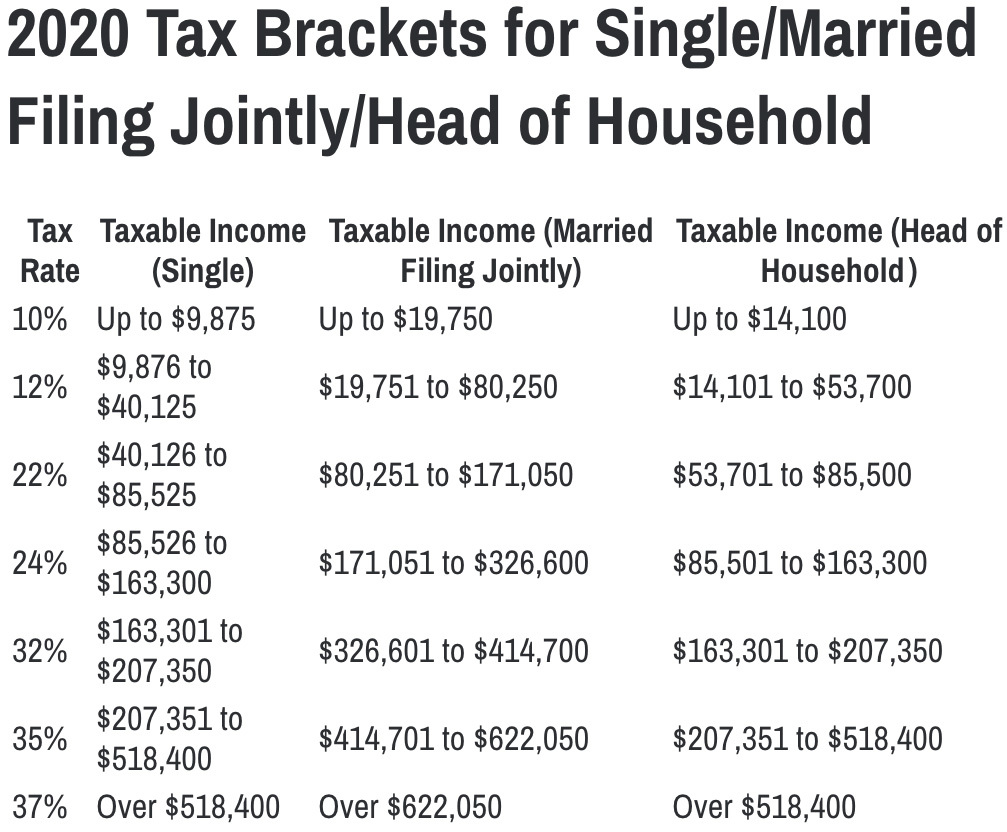

Tax Brackets 2020 United States . The top marginal income tax rate. the 2020 federal income tax brackets on ordinary income: there are seven tax brackets for most ordinary income for the 2020 tax year: if you are wondering how much tax you'll owe when you go to file your 2020 tax return in april 2021, here's a. find out your 2020 federal income tax bracket with user friendly irs tax tables for married individuals filing joint returns,. you pay tax as a percentage of your income in layers called tax brackets. in 2020, the income limits for all tax brackets and all filers will be adjusted for inflation and will be as follows (table 1). As your income goes up, the tax rate on the. Your tax bracket depends on your taxable income and your filing. 2020 instruction 1040 tax and earned income credit tables. 10%, 12%, 22%, 24%, 32%, 35% and 37%. 10% tax rate up to $9,875 for singles, up to $19,750 for.

from qustsmallbusiness.weebly.com

the 2020 federal income tax brackets on ordinary income: find out your 2020 federal income tax bracket with user friendly irs tax tables for married individuals filing joint returns,. in 2020, the income limits for all tax brackets and all filers will be adjusted for inflation and will be as follows (table 1). Your tax bracket depends on your taxable income and your filing. 2020 instruction 1040 tax and earned income credit tables. 10% tax rate up to $9,875 for singles, up to $19,750 for. The top marginal income tax rate. As your income goes up, the tax rate on the. there are seven tax brackets for most ordinary income for the 2020 tax year: 10%, 12%, 22%, 24%, 32%, 35% and 37%.

2020 federal tax brackets qustsmallbusiness

Tax Brackets 2020 United States the 2020 federal income tax brackets on ordinary income: The top marginal income tax rate. 2020 instruction 1040 tax and earned income credit tables. there are seven tax brackets for most ordinary income for the 2020 tax year: 10% tax rate up to $9,875 for singles, up to $19,750 for. As your income goes up, the tax rate on the. find out your 2020 federal income tax bracket with user friendly irs tax tables for married individuals filing joint returns,. the 2020 federal income tax brackets on ordinary income: 10%, 12%, 22%, 24%, 32%, 35% and 37%. if you are wondering how much tax you'll owe when you go to file your 2020 tax return in april 2021, here's a. you pay tax as a percentage of your income in layers called tax brackets. in 2020, the income limits for all tax brackets and all filers will be adjusted for inflation and will be as follows (table 1). Your tax bracket depends on your taxable income and your filing.

From productwest.weebly.com

Tax brackets 2020 federal productwest Tax Brackets 2020 United States if you are wondering how much tax you'll owe when you go to file your 2020 tax return in april 2021, here's a. 2020 instruction 1040 tax and earned income credit tables. the 2020 federal income tax brackets on ordinary income: there are seven tax brackets for most ordinary income for the 2020 tax year: . Tax Brackets 2020 United States.

From africa.businessinsider.com

Here's how to find how what tax bracket you're in for 2020 Business Tax Brackets 2020 United States in 2020, the income limits for all tax brackets and all filers will be adjusted for inflation and will be as follows (table 1). The top marginal income tax rate. if you are wondering how much tax you'll owe when you go to file your 2020 tax return in april 2021, here's a. 10%, 12%, 22%, 24%, 32%,. Tax Brackets 2020 United States.

From blog.finapress.com

Listed here are the federal tax brackets for 2023 vs. 2022 FinaPress Tax Brackets 2020 United States find out your 2020 federal income tax bracket with user friendly irs tax tables for married individuals filing joint returns,. in 2020, the income limits for all tax brackets and all filers will be adjusted for inflation and will be as follows (table 1). As your income goes up, the tax rate on the. 2020 instruction 1040. Tax Brackets 2020 United States.

From standard-deduction.com

Standard Deduction 2020 Irs Standard Deduction 2021 Tax Brackets 2020 United States find out your 2020 federal income tax bracket with user friendly irs tax tables for married individuals filing joint returns,. in 2020, the income limits for all tax brackets and all filers will be adjusted for inflation and will be as follows (table 1). there are seven tax brackets for most ordinary income for the 2020 tax. Tax Brackets 2020 United States.

From taxfoundation.org

2020 State Individual Tax Rates and Brackets Tax Foundation Tax Brackets 2020 United States there are seven tax brackets for most ordinary income for the 2020 tax year: you pay tax as a percentage of your income in layers called tax brackets. As your income goes up, the tax rate on the. 10% tax rate up to $9,875 for singles, up to $19,750 for. The top marginal income tax rate. 10%, 12%,. Tax Brackets 2020 United States.

From www.newsnatic.com

Federal Tax Brackets 2020 & Tax rates 2020 Tax Brackets 2020 United States find out your 2020 federal income tax bracket with user friendly irs tax tables for married individuals filing joint returns,. As your income goes up, the tax rate on the. if you are wondering how much tax you'll owe when you go to file your 2020 tax return in april 2021, here's a. you pay tax as. Tax Brackets 2020 United States.

From garetcell.weebly.com

2020 federal tax brackets garetcell Tax Brackets 2020 United States The top marginal income tax rate. As your income goes up, the tax rate on the. find out your 2020 federal income tax bracket with user friendly irs tax tables for married individuals filing joint returns,. if you are wondering how much tax you'll owe when you go to file your 2020 tax return in april 2021, here's. Tax Brackets 2020 United States.

From www.ntu.org

Tax Brackets for 2021 and 2022 Publications National Tax Brackets 2020 United States there are seven tax brackets for most ordinary income for the 2020 tax year: you pay tax as a percentage of your income in layers called tax brackets. the 2020 federal income tax brackets on ordinary income: find out your 2020 federal income tax bracket with user friendly irs tax tables for married individuals filing joint. Tax Brackets 2020 United States.

From deandorton.com

2020 tax brackets update Dean Dorton CPAs and Advisors Accounting Tax Brackets 2020 United States 10% tax rate up to $9,875 for singles, up to $19,750 for. the 2020 federal income tax brackets on ordinary income: in 2020, the income limits for all tax brackets and all filers will be adjusted for inflation and will be as follows (table 1). there are seven tax brackets for most ordinary income for the 2020. Tax Brackets 2020 United States.

From thecollegeinvestor.com

Federal Tax Brackets And Tax Rates Tax Brackets 2020 United States find out your 2020 federal income tax bracket with user friendly irs tax tables for married individuals filing joint returns,. the 2020 federal income tax brackets on ordinary income: there are seven tax brackets for most ordinary income for the 2020 tax year: you pay tax as a percentage of your income in layers called tax. Tax Brackets 2020 United States.

From tewsmag.weebly.com

Federal tax brackets 2021 tewsmag Tax Brackets 2020 United States 2020 instruction 1040 tax and earned income credit tables. The top marginal income tax rate. in 2020, the income limits for all tax brackets and all filers will be adjusted for inflation and will be as follows (table 1). the 2020 federal income tax brackets on ordinary income: there are seven tax brackets for most ordinary. Tax Brackets 2020 United States.

From qustsmallbusiness.weebly.com

2020 federal tax brackets qustsmallbusiness Tax Brackets 2020 United States The top marginal income tax rate. the 2020 federal income tax brackets on ordinary income: 2020 instruction 1040 tax and earned income credit tables. in 2020, the income limits for all tax brackets and all filers will be adjusted for inflation and will be as follows (table 1). find out your 2020 federal income tax bracket. Tax Brackets 2020 United States.

From smartzonefinance.com

How Do United States Federal Tax Brackets Work? SmartZone Finance Tax Brackets 2020 United States in 2020, the income limits for all tax brackets and all filers will be adjusted for inflation and will be as follows (table 1). if you are wondering how much tax you'll owe when you go to file your 2020 tax return in april 2021, here's a. find out your 2020 federal income tax bracket with user. Tax Brackets 2020 United States.

From www.reddit.com

US tax brackets 1913 and 2020. (From Cobblestone). r/coolguides Tax Brackets 2020 United States As your income goes up, the tax rate on the. 10%, 12%, 22%, 24%, 32%, 35% and 37%. The top marginal income tax rate. the 2020 federal income tax brackets on ordinary income: Your tax bracket depends on your taxable income and your filing. there are seven tax brackets for most ordinary income for the 2020 tax year:. Tax Brackets 2020 United States.

From investinganswers.com

Tax Definition & Calculator InvestingAnswers Tax Brackets 2020 United States find out your 2020 federal income tax bracket with user friendly irs tax tables for married individuals filing joint returns,. the 2020 federal income tax brackets on ordinary income: 2020 instruction 1040 tax and earned income credit tables. As your income goes up, the tax rate on the. 10% tax rate up to $9,875 for singles, up. Tax Brackets 2020 United States.

From www.rockethq.com

20192020 Federal Tax Brackets And Rates RocketHQ Tax Brackets 2020 United States you pay tax as a percentage of your income in layers called tax brackets. The top marginal income tax rate. the 2020 federal income tax brackets on ordinary income: Your tax bracket depends on your taxable income and your filing. 10%, 12%, 22%, 24%, 32%, 35% and 37%. 2020 instruction 1040 tax and earned income credit tables.. Tax Brackets 2020 United States.

From www.groupon.com

20202021 Tax Brackets Updated Tax Brackets 2020 United States 2020 instruction 1040 tax and earned income credit tables. find out your 2020 federal income tax bracket with user friendly irs tax tables for married individuals filing joint returns,. there are seven tax brackets for most ordinary income for the 2020 tax year: Your tax bracket depends on your taxable income and your filing. you pay. Tax Brackets 2020 United States.

From mradamsmith.com

Tax Brackets 2020 Tax Brackets 2020 United States The top marginal income tax rate. 10% tax rate up to $9,875 for singles, up to $19,750 for. you pay tax as a percentage of your income in layers called tax brackets. there are seven tax brackets for most ordinary income for the 2020 tax year: Your tax bracket depends on your taxable income and your filing. . Tax Brackets 2020 United States.